student loan debt relief tax credit for tax year 2020

Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt Main_Content Governor Larry Hogan and Maryland Higher Education Commission. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan.

In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria.

. Beginning in the 2022 tax year employers will be provided with a 50 tax credit of up to 2625 per year for payments made on a student loan. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings. The refundable tax credit must be claimed against the State income tax for the taxable year in which the Maryland Higher Education Commission certifies.

A student mortgage debt settlement income tax loans is actually a program made under 10-740 regarding the Tax-General piece from the Annotated rule of Maryland to supply. Have at least 5000 in outstanding student loan debt upon. Employees must be a state.

The maximum credit is 5000. Will have maintained residency within the state of Maryland for the 2020 tax year Have. A copy of your Maryland tax get back for the most present past tax 12 months.

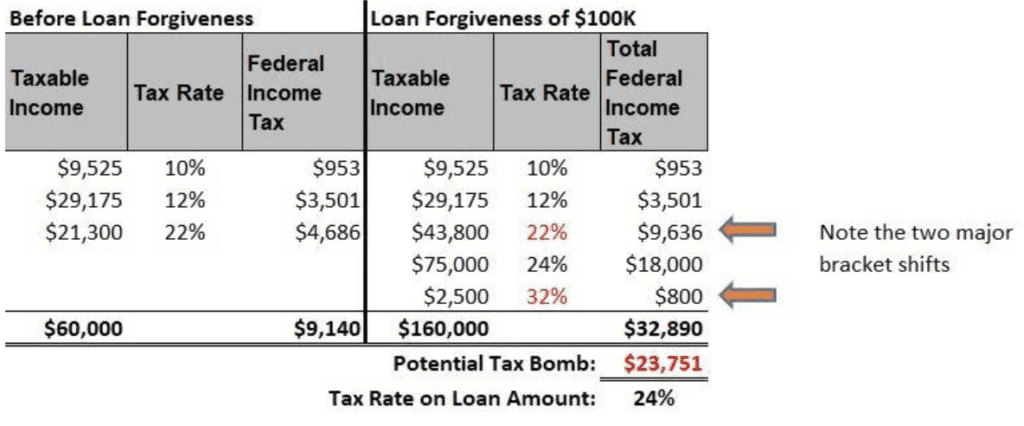

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan. Additional prioritization criteria are set forth in 10-740 of the Tax-General Article of the Annotated Code of Maryland and in the implementing regulations. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

While you wont owe the IRS any money -- a provision tucked into the 19 trillion American Rescue Act COVID relief package passed in March 2021 eliminates federal taxes on. For Maryland Residents or Part-year Residents Tax Year 2020 Only. In Indiana for example the state tax rate is 323.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. If requested I will provide proof of income to the US.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. I request federal student loan debt relief of up to 20000. Instructions are at the end of this application.

Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details. There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions. Have incurred at least 20000 in undergraduate andor graduate student loan debt.

Review and Submit the Agreement. The Maryland Higher Education Commissionmay request additional. The deduction is gradually reduced and eventually eliminated by phaseout.

Have the debt be in their the Taxpayers name.

Student Loan Forgiveness Government Offers Updates On Eligibility

/cdn.vox-cdn.com/uploads/chorus_asset/file/22163262/Lespn_attitudes_toward_biden_canceling_student_debt_.png)

Can Joe Biden Cancel Student Loan Debt Without Congress Vox

President Announces Student Loan Forgiveness Eligibility Details Application And Tax Implications Wolters Kluwer

Covid Tax Break Could Open Door To Student Loan Forgiveness Ap News

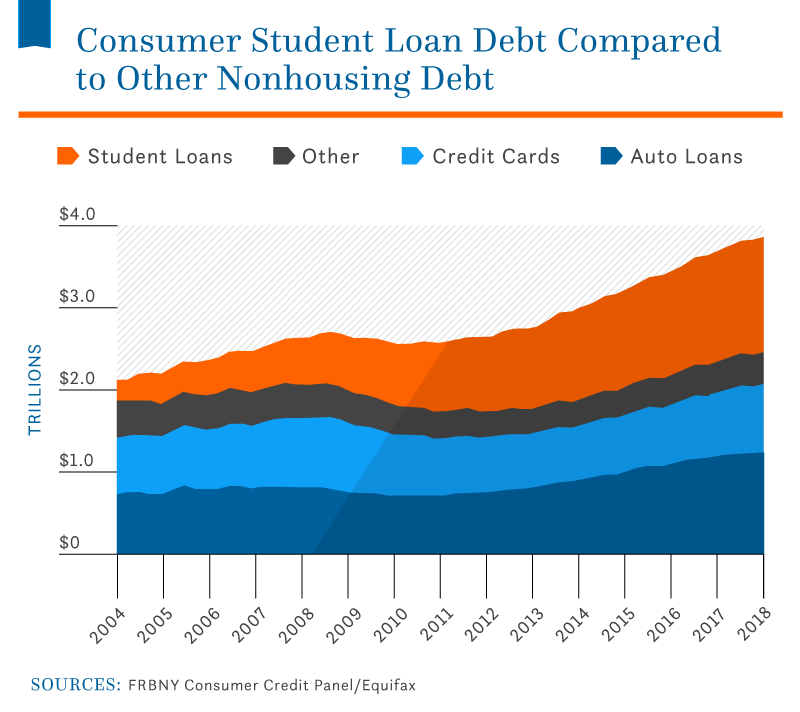

Student Loan Debt 2022 Facts Statistics Nitro

How To Claim The Maryland Student Loan Tax Credit Fire Esquire

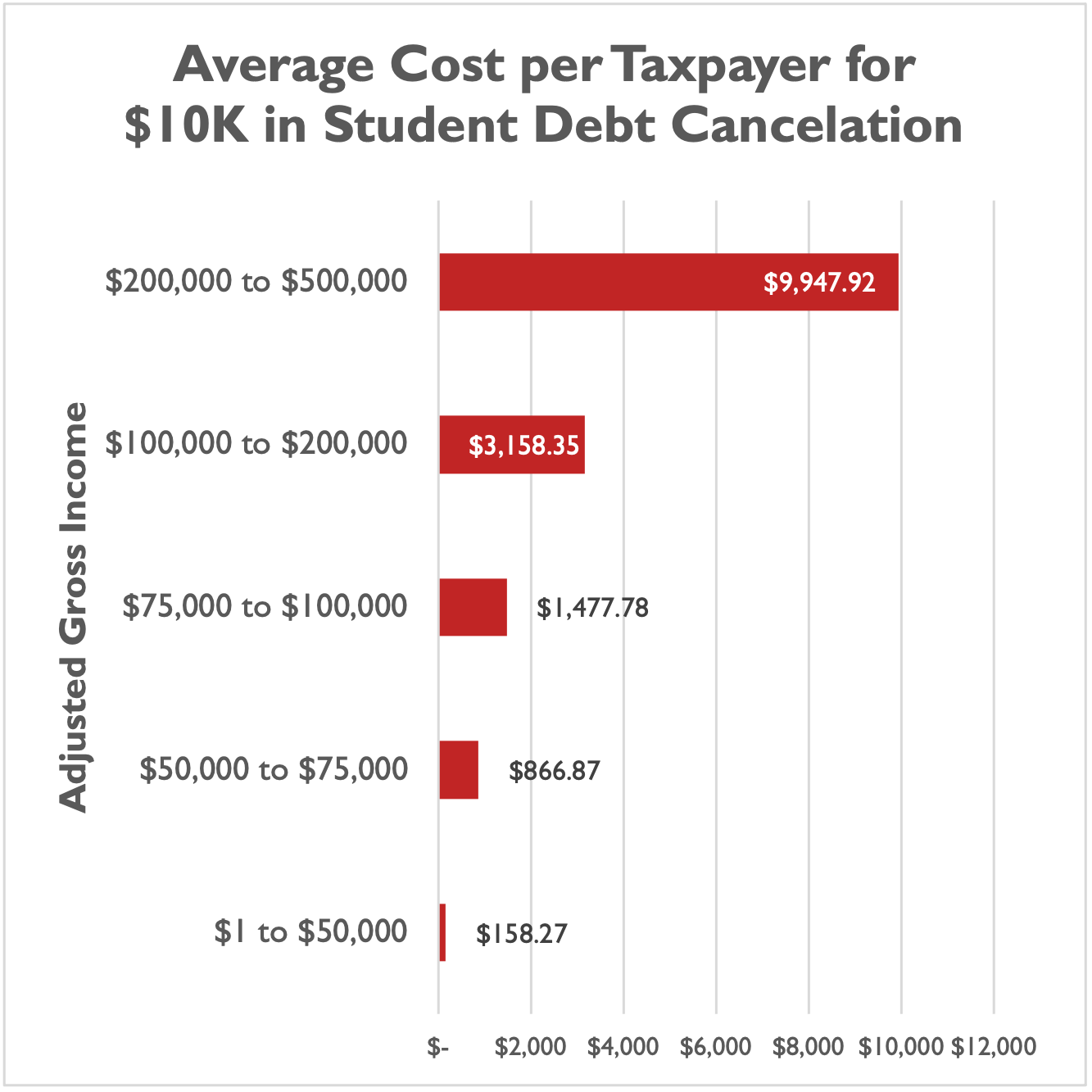

Cost Of Student Debt Cancelation Could Average 2 000 Per Taxpayer Foundation National Taxpayers Union

Gov Wolf Reminds Pennsylvanians Student Loan Forgiveness Will Not Be Taxed In Pa

What Are The Pros And Cons Of Student Loan Forgiveness

2022 Student Loan Forgiveness Program H R Block

Biden S Student Loan Forgiveness Plan Your Questions Answered The New York Times

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

Who Qualifies For Student Loan Forgiveness Under Biden S Plan

Biden Student Loan Forgiveness Faqs The Details Explained Forbes Advisor

Will Student Loan Repayment At Long Last Be A Game Changer

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Everyone Has Opinions About Student Loan Forgiveness Bloomberg

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Student Loans Aren T Going Away Any Time Soon So What S Next