new haven county property taxes

New Haven County Property Records Search Links. Tuesday Wednesday Thursday and Friday 8 am.

City Of New Haven Cityofnewhaven Twitter

These buyers bid for an interest rate on the taxes owed and the right to.

. Freedom of Information Act. If you run a credible property tax law company that offers protest reduction and appeal legal services for residential and commercial properties in New Haven County Connecticut apply to get listed on our directory. Waste and Recycling Service.

If you have received a tax bill from a towncity in which you did not reside in or garage your vehicle in as of October 1 2020 contact the Assessor to request a transfer to the correct towncity of residency as of October 1 2020. Personal property and motor vehicle are computed in the same manner. Home Shopping Cart Checkout.

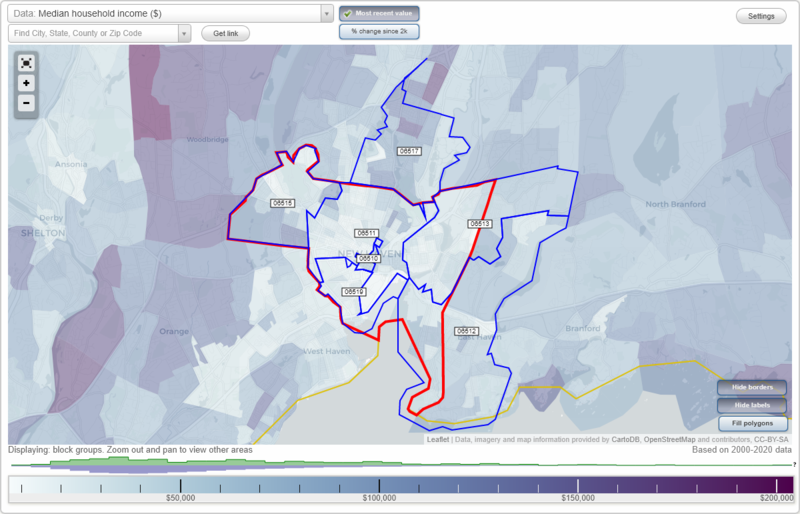

City Of New Haven. Or by phone at 860 263-5153. Instantly view essential data points on New Haven County as well as CT effective tax rates median real estate taxes paid home values income levels and even homeownership rates.

New Haven County collects on average 169 of a propertys assessed fair market value as property tax. If you are already living here only pondering taking up residence in New Haven. View Cart Checkout.

NETR Online New Haven New Haven Public Records Search New Haven Records New Haven Property Tax Connecticut Property Search Connecticut Assessor From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film. BSA Software and a fast growing list of governmental municipalities have created a partnership to help provide a fast and convenient way for their constituents to view valuable data online. New Haven County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

The New Haven County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within New Haven County and may establish the amount of tax due on that property based on. Name Search by Name through Property and Tax Records. Effective property tax rates in New Haven are the highest in the state of Connecticut.

The median property tax also known as real estate tax in New Haven County is 462100 per year based on a median home value of 27330000 and a median effective property tax rate of 169 of property value. New Haven County CT currently has 888 tax liens available as of March 25. We always look for reputable property tax lawyers to add to our New Haven Countys vendor list.

GFL - Green For Life Waste Removal. This translates to a median annual property tax payment of 5744 good for second-largest in the state. New Haven County Assessors Office Services.

The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300. Having trouble searching. New Haven Township Shiawassee County MI.

Records include New Haven County property tax assessments deeds title records property ownership building permits zoning land records GIS maps more. Will pay a tax of 43880. Our New Haven County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Connecticut and across the entire United States.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in New Haven County CT at tax lien auctions or online distressed asset sales. It is bordered on the northwest by Litchfield County on the north by Hartford County on the east by Middlesex County and on the west by Fairfield CountyIts southern border is Long Island Sound where it shares a water boundary with Suffolk County in. These records can include New Haven County property tax assessments and assessment challenges appraisals and income taxes.

The countywide average effective rate is 233. New Haven County has one of the highest median property taxes in the United States and is ranked 39th of the 3143 counties in order of median. DMV Property Tax Unit.

Parcel Number Search by Parcel Number through Property and Tax Records. To use the calculator just enter your propertys current market value such as a current appraisal or a. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in New Haven County CT at tax lien auctions or online distressed asset sales.

The cities of New Haven and Waterbury are two of the most populous metropolises in New Haven County. The DMVs Property Tax Section may be reached by mail at. Account info last updated on Mar 28 2022 0 Bills - 000 Total.

The Town of New Haven is offering alternative options for making Property Tax payments. Address Search by Address through Property and Tax Records. The Town is encouraging residents to mail their payments to New Haven Tax Collector PO.

Therefore a property assessed at 10000. The New Haven County Property Records Search Connecticut links below open in a new window and take you to third party websites that provide access to New Haven County public records. The City of New Haven.

Get FREE NEW HAVEN COUNTY PROPERTY RECORDS directly from 100 Connecticut govt offices 122 official property records databases. New Haven County Stats for Property Taxes. Use the Newly Enhanced Comparable Search.

Editors frequently monitor and verify these resources on a routine basis. New Haven County Connecticuts third most populous county was formed in 1666 but its final boundary was not settled until 1807. Box 141 New Haven NY 13121 or try the link above where payments can be made by either credit card or e.

Veterans below a certain income level andor disabled veterans are eligible for additional property tax exemptions. Welcome to the Internet Services Site a cutting-edge internet solution for Government. Notice of Compliance for Exterior Property Areas.

Veterans who have ninety 90 days of wartime service including Merchant Marines who served during WWII are eligible for a 1500 exemption for property tax purposes eg real estate property or automobiles. The median property tax on a 27330000 house is 461877 in New. Learn how New Haven applies its real property taxes with this thorough overview.

New Haven County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in New Haven County Connecticut. New Haven County CT currently has 888 tax liens available as of March 25. GFL in The New Haven Community.

Looking for more property tax statistics in your area.

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

City Of New Haven Cityofnewhaven Twitter

States With The Highest Property Taxes

Connecticut Property Tax Calculator Smartasset

How Healthy Is New Haven County Connecticut Us News Healthiest Communities

City Of New Haven Cityofnewhaven Twitter

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Living In New Haven Ct U S News Best Places

New Haven Financially Speaking A Slowly Sinking Ship

New Haven Connecticut Ct Zip Code Map Locations Demographics List Of Zip Codes

Living In New Haven Ct U S News Best Places

City Of New Haven Cityofnewhaven Twitter

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders